omaha ne sales tax calculator

Request a Business Tax Payment Plan. How much is sales tax in omaha.

26 Of Us S Richest Billionaires Paid 4 8 Percent Tax Rate In Recent Years

Driver and Vehicle Records.

. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Nebraska Documentation Fees. Make a Payment Only.

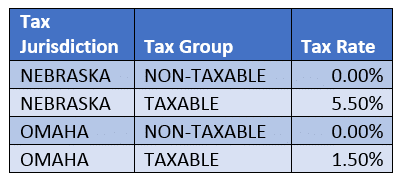

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. The calculator will show you the total sales tax amount as well as the county city.

Nebraska sales tax details. The Omaha Nebraska sales tax rate of 7 applies to the following 39 zip codes. The Nebraska NE state sales tax rate is currently 55.

You can find more tax rates and. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective. Nebraska Sales and Use Tax The Nebraska state sales and use tax rate is 55 055.

Sales tax in omaha nebraska is currently 7. Sales and Use Tax. Registration Fees and Taxes.

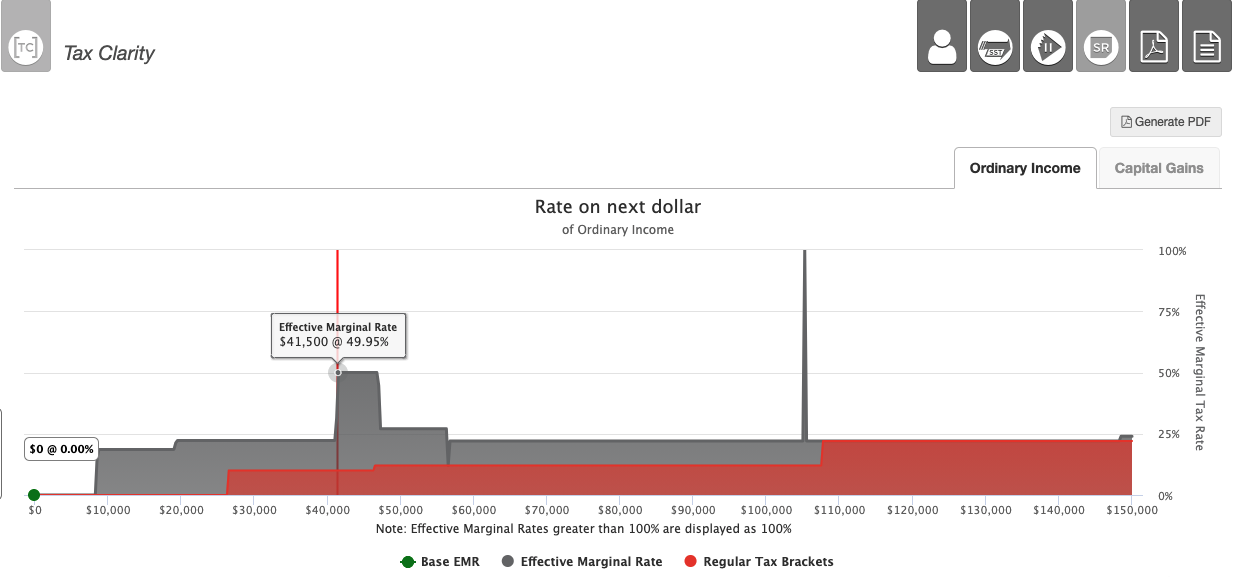

There are four tax brackets in. Sales Tax State Local Sales Tax on Food. The Nebraska state sales and.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The nebraska state sales and use tax rate is 55 055. This is the total of state county and city sales tax rates.

Nebraska Capital Gains Tax. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. How much is sales tax in omaha.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. That means they are taxed at the rates listed above 246 -. Method to calculate Omaha sales tax in 2022.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. Nebraskas state income tax system is similar to the federal system. The December 2020 total local sales tax rate was also.

Real property tax on median home. Omaha NE Sales Tax Rate Omaha NE Sales Tax Rate The current total local sales tax rate in Omaha NE is 7000. Its a progressive system which means that taxpayers who earn more pay higher taxes.

Sales tax in omaha nebraska is currently 7. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Sales Tax Rate Finder.

Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. Long- and short-term capital gains are included as regular income on your Nebraska income tax return. The Nebraska state sales and use tax rate is 55 055.

If youre an online business you can connect TaxJar directly to your shopping cart and. The Omaha Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Omaha Nebraska in the USA using average Sales Tax Rates andor. The nebraska state sales and use tax rate is 55 055.

The Nebraska sales tax rate is currently.

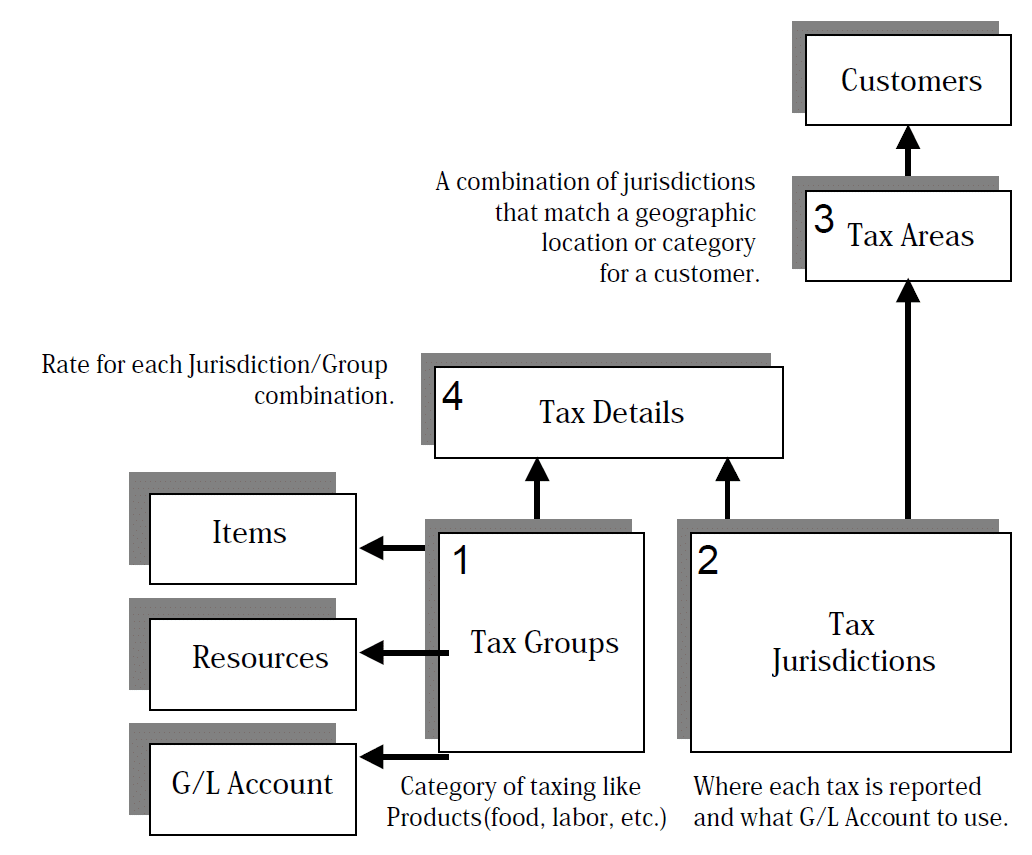

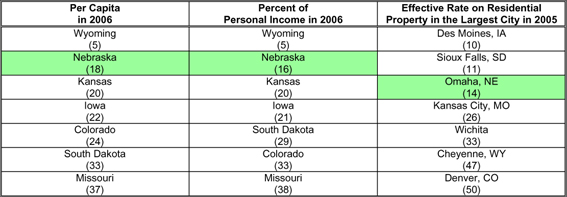

Taxes And Spending In Nebraska

![]()

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Loan Calculator Metro Credit Union Omaha Ne Best Loans Rates

Motor Vehicles Douglas County Treasurer

Sales Taxes In The United States Wikiwand

How Much Does It Really Cost To Sell A House In Nebraska

Cryptocurrency Tax Calculator Forbes Advisor

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Sales Tax Calculator And Rate Lookup Tool Avalara

Cell Phone Taxes And Fees In 2018 Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/ERD7U2NLDJAL5B5TXL3JGLQZ4Y.jpg)

Downtown Omaha Plan Adds Streetcar Puts Mutual Of Omaha Into Current Library Space

Nebraska State Tax Things To Know Credit Karma